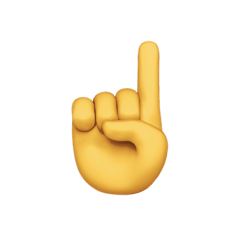

Zoe Financial

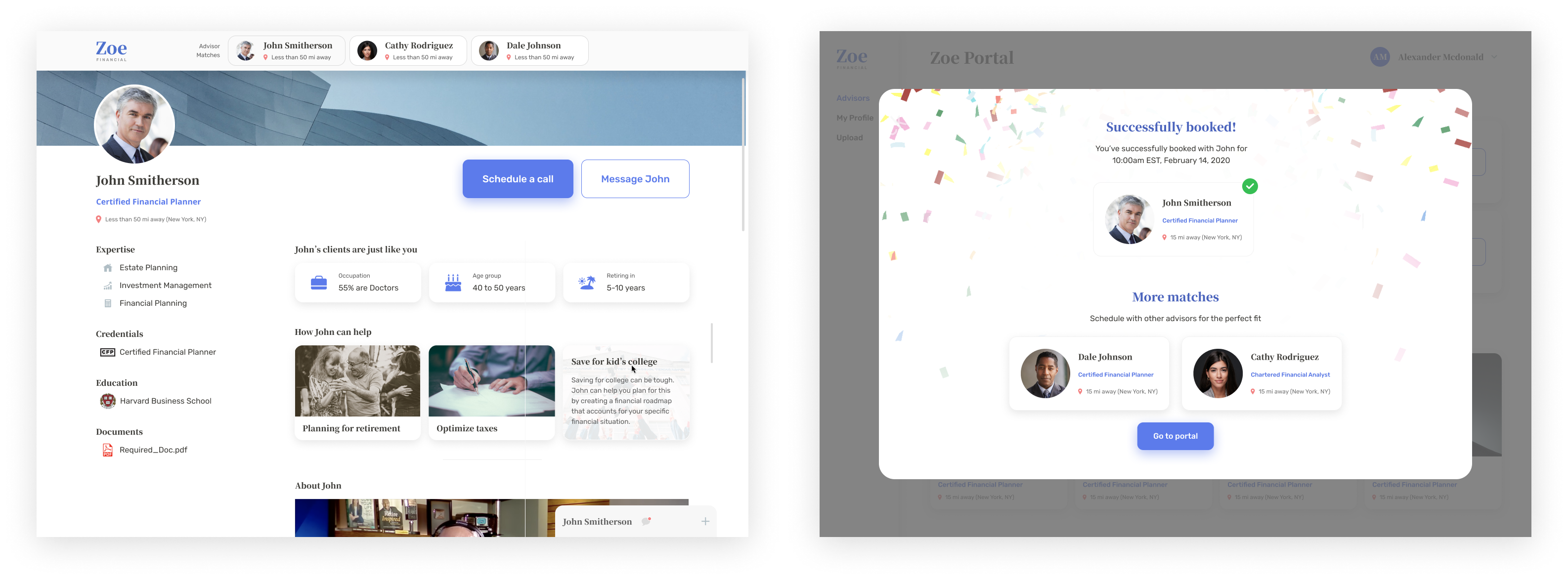

Zoe Financial is an online platform that matches consumers with the top 5% independent financial advisors and planners across the country. Zoe empathizes with “the people" by matching advisors based on consumer needs and life circumstances.

Goal

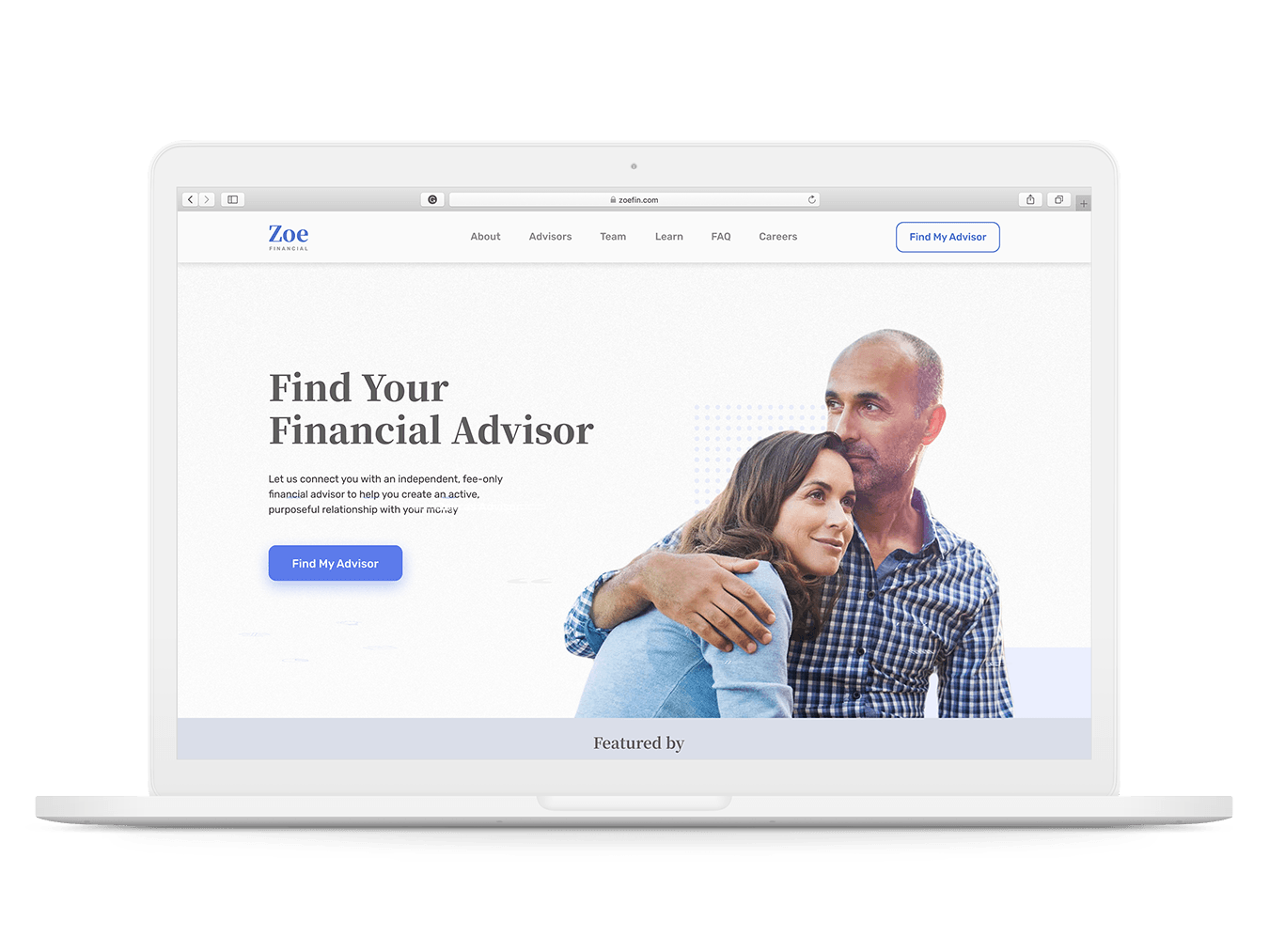

Zoe needed a refined online experience for consumers, advisors, and investors to increase engagement and prospect conversion.

- Design a web experience that improves conversion for both consumers & advisors.

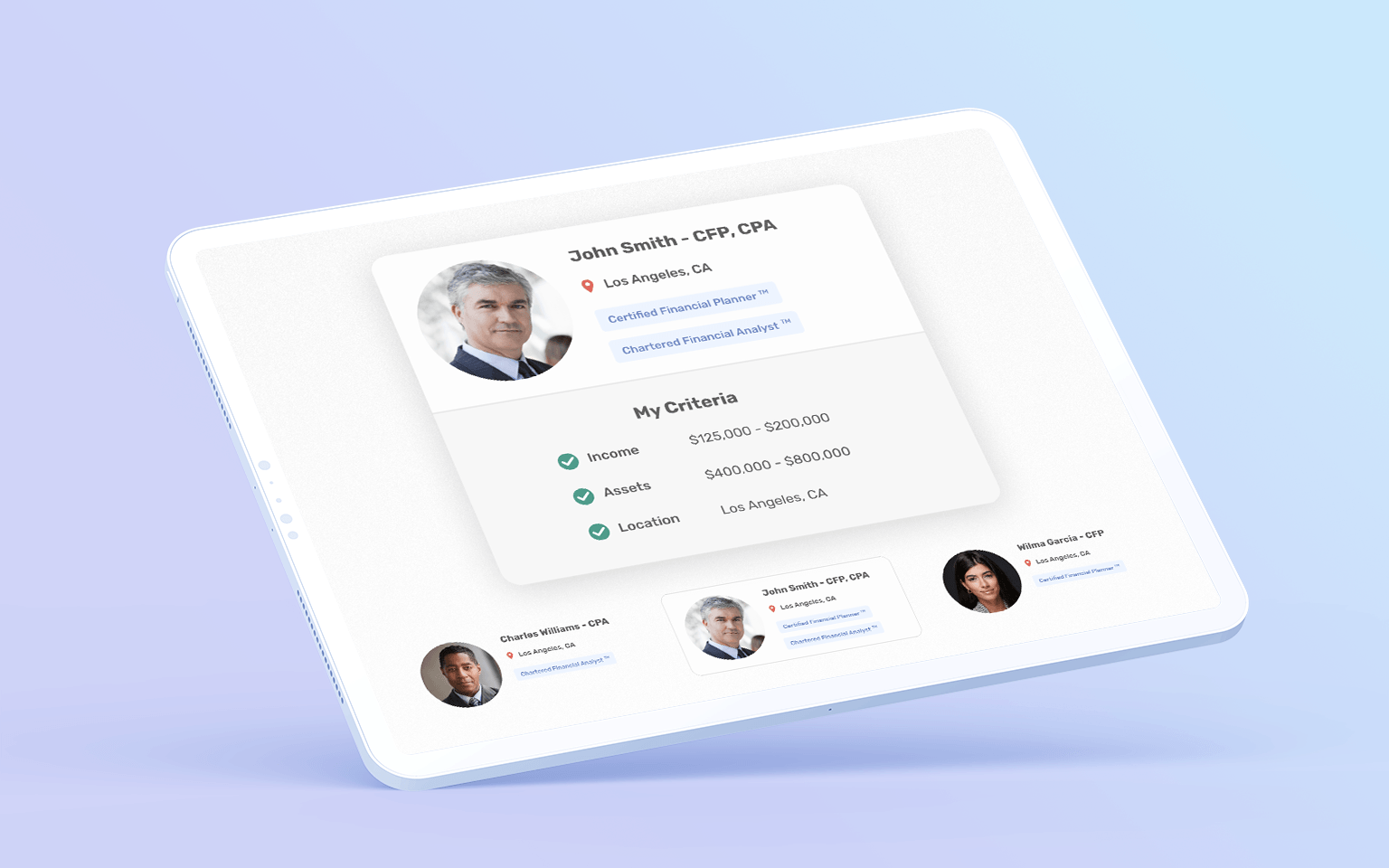

- Increase engagement of their consumer survey form for higher scheduling rates.

- Design an advisor portal with pipeline analytics to optimize prospect management and conversion.

Discovery

Target users

Age 40 to 60 - Typically older individuals or couples who are not experts in finance but seek financial stability.

Risk-averse - Recognize the importance of choosing the right advisor who is trustworthy and informed.

Growth - Users in the life stage to grow their wealth with confidence.

Values

Trust & credibility - Users are risk-averse; They require a high level of trust in the advisor to guide the risk-taking. A credible provider is needed to avoid the risk of a negative or fraudulent experience.

Transparency & authenticity - Users seek an advisor with good intentions and nature.

Advisor relationship - User understanding of financial advisement is limited and they need personalized education or a road map to feel confident in their decisions.

Pain points

Conversion - Zoe's overall web experience (marketing, value proposition, and onboarding) was not very engaging or inspiring.

Brand authority - Zoe's visual language did not reflect the refined qualities the target users seek (mature, authoritative, & trustworthy).

Design

Architecture

I scoped the legacy information architecture to fully understand the boundaries of the experience. I identified the pain points and growth areas of each page to prioritized based on level of impact vs. level of effort.

User journey

I created a user journey map to capture the end-to-end experience from a market qualified lead to advisor client. This map is the strategic backbone to drive concept to execution.

Service blueprint

I created a service blueprint to interaction landscape in detail. This drives the necessary requirements clearly and sets expectations early.

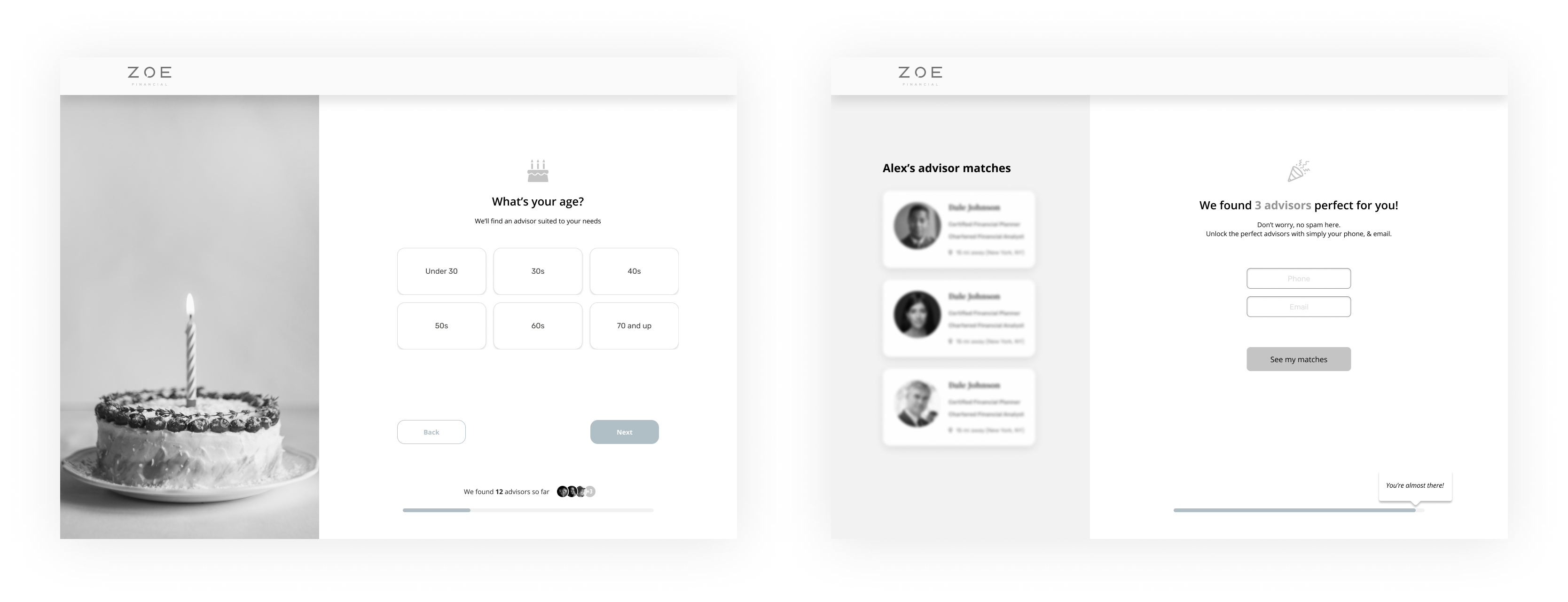

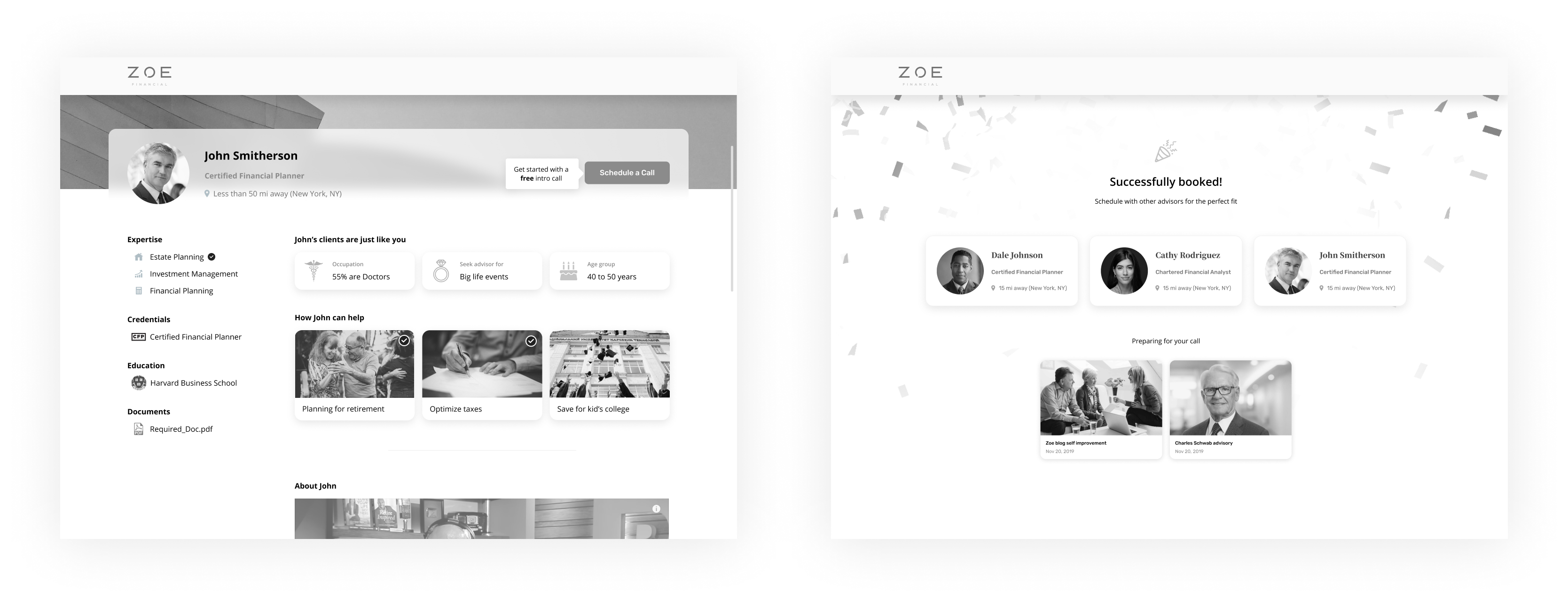

Wireframing

I wireframed the marketing site, onboarding survey, and advisor matching process in phases for rapid feedback and iteration.

Rapid Iteration

A full scope project will have at least 300 comments. Refinement is just the name of the game for a better end product.

Visuals

I applied a modern, balanced, yet minimal visual style to cater to a more sophisticated generation. Creating a clean and mature online presence was key to building trust and empathizing with the core audience.

Results

Successes

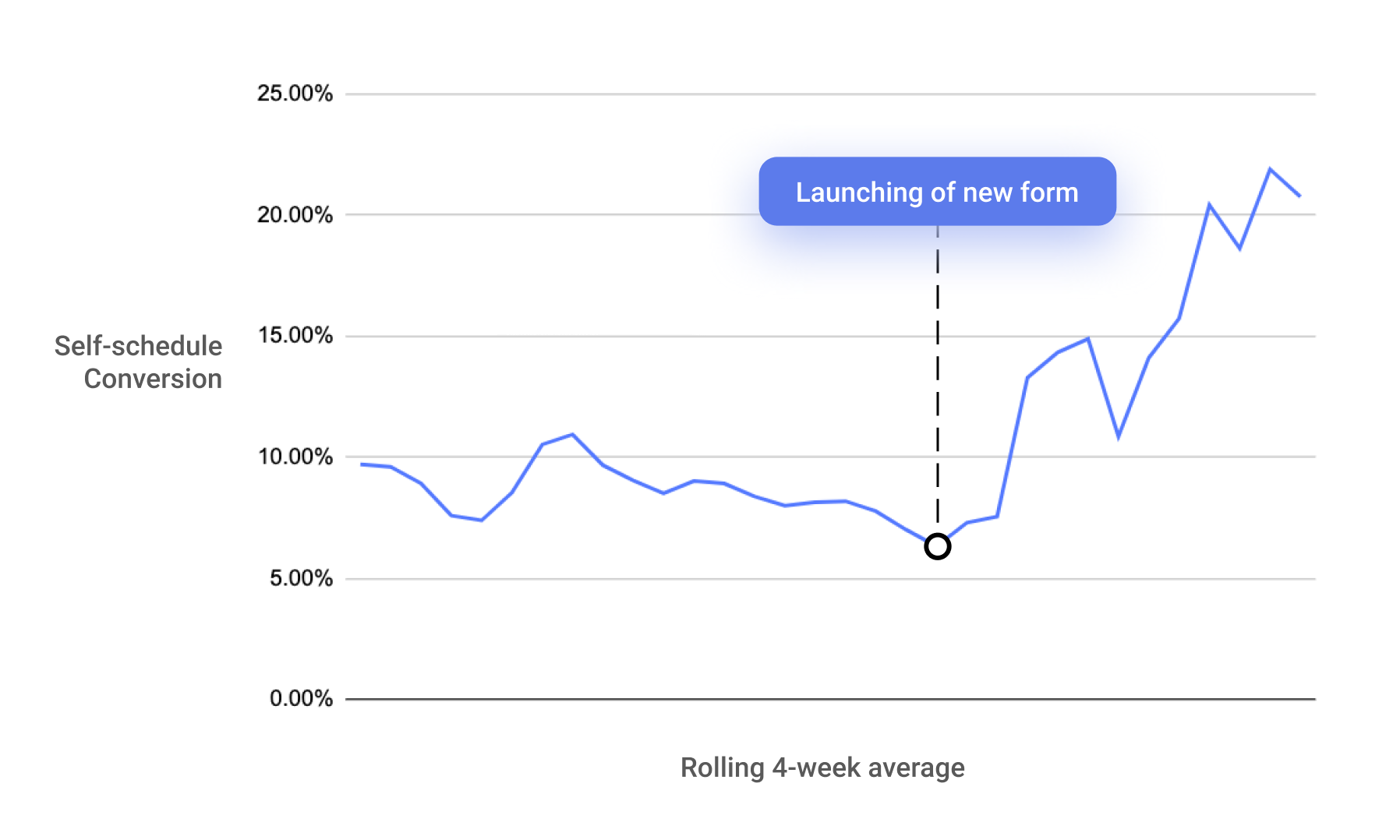

- 20% increase in consumer scheduling rate with advisor matches.

- Simplified architecture and complete UX/UI redesign for marketing, onboarding, and advisor dashboard for desktop and mobile.

- Communicated brand identity of trust, authority, and empathy through a clean and modernized visual style.

Lessons Learned

- The user is a deep well of personalities, life circumstances, motivations, and behaviors. Understanding this in detail ultimately shapes the final experience.

- User testing always reveals what decisions were speculative or based on truth. Human testing is the key to real and raw data.

- Brand identity can be quite amorphous but still can be broken down and translated into very logical design decisions.

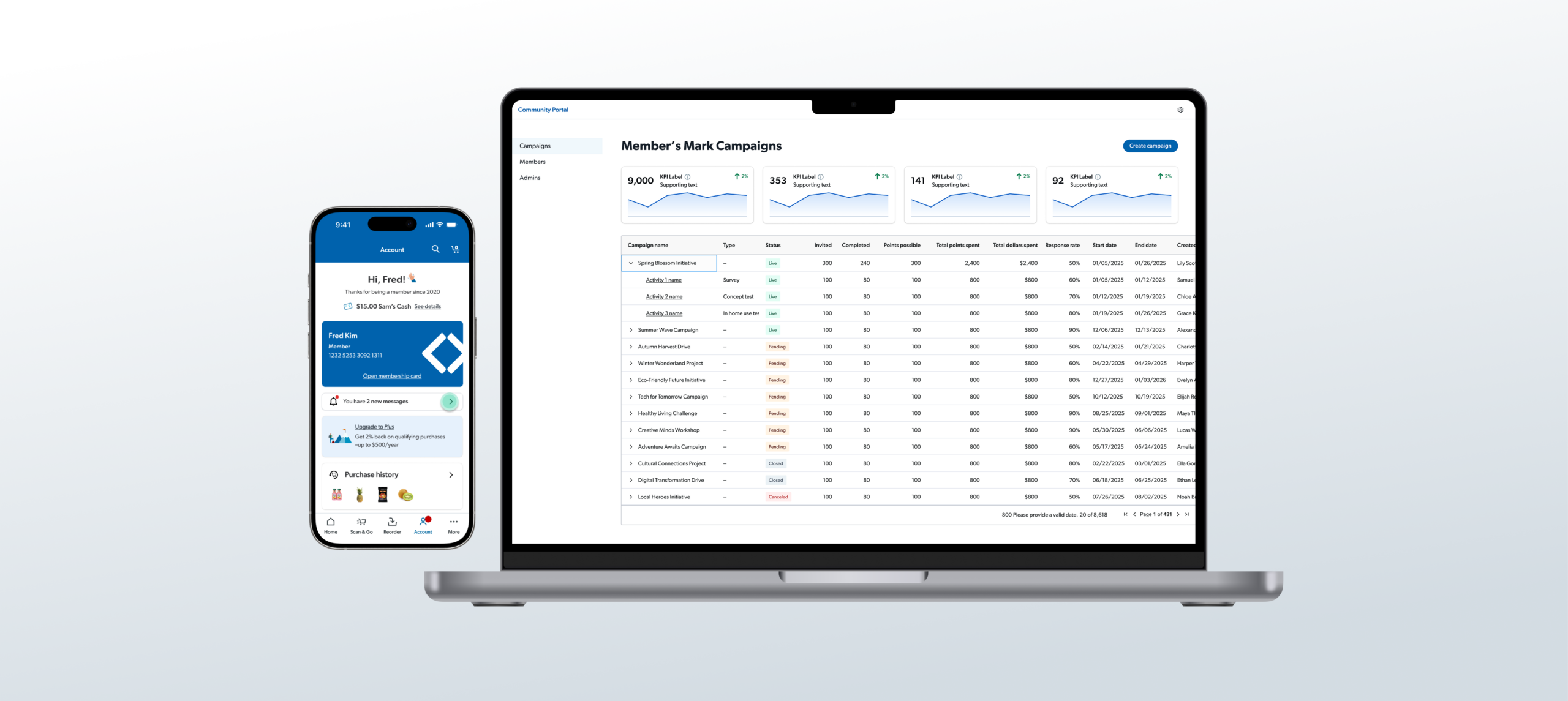

Walmart (Sam's Club)Coming soon 🚧

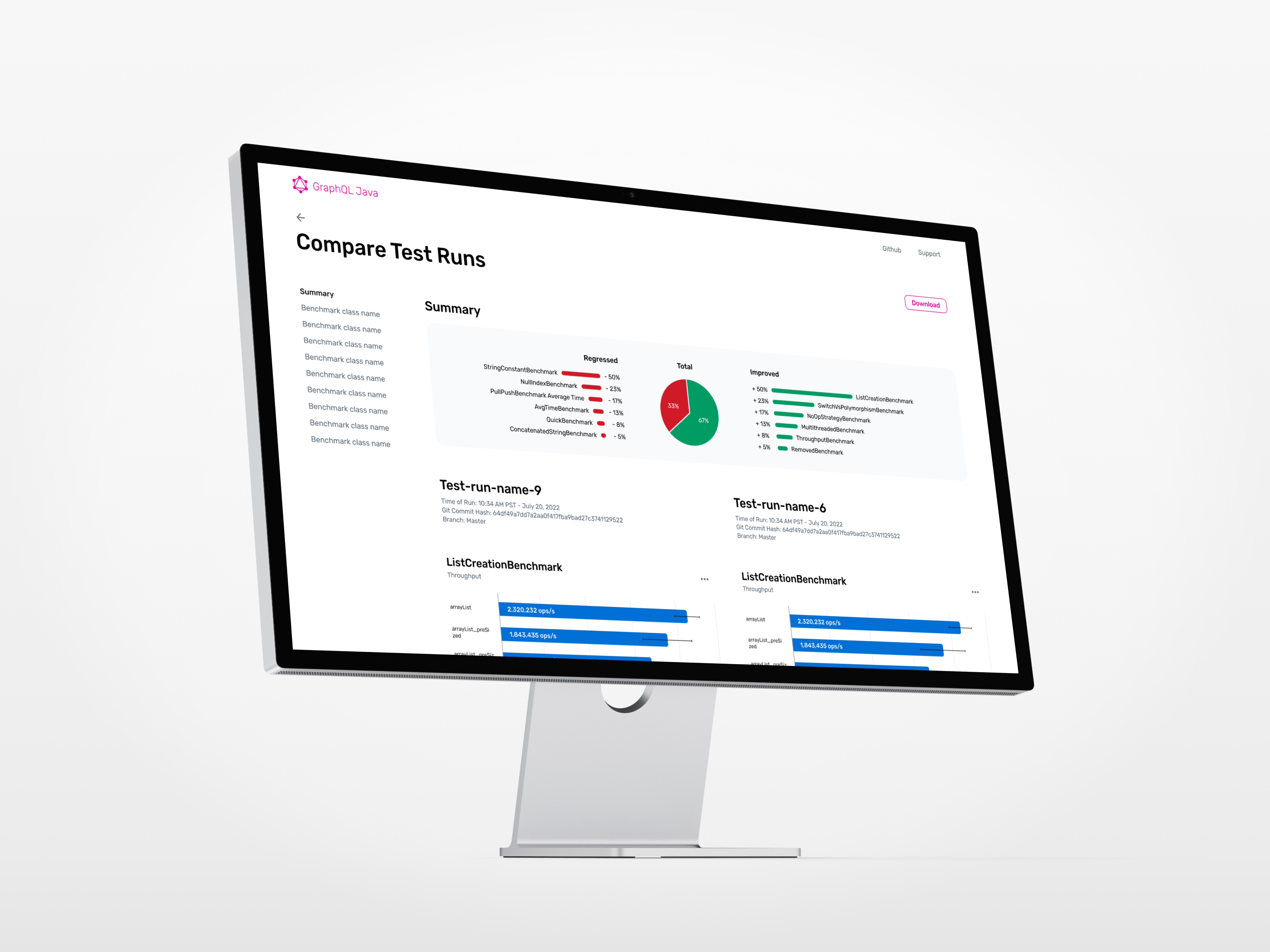

TwitterEnterprise, Design Systems

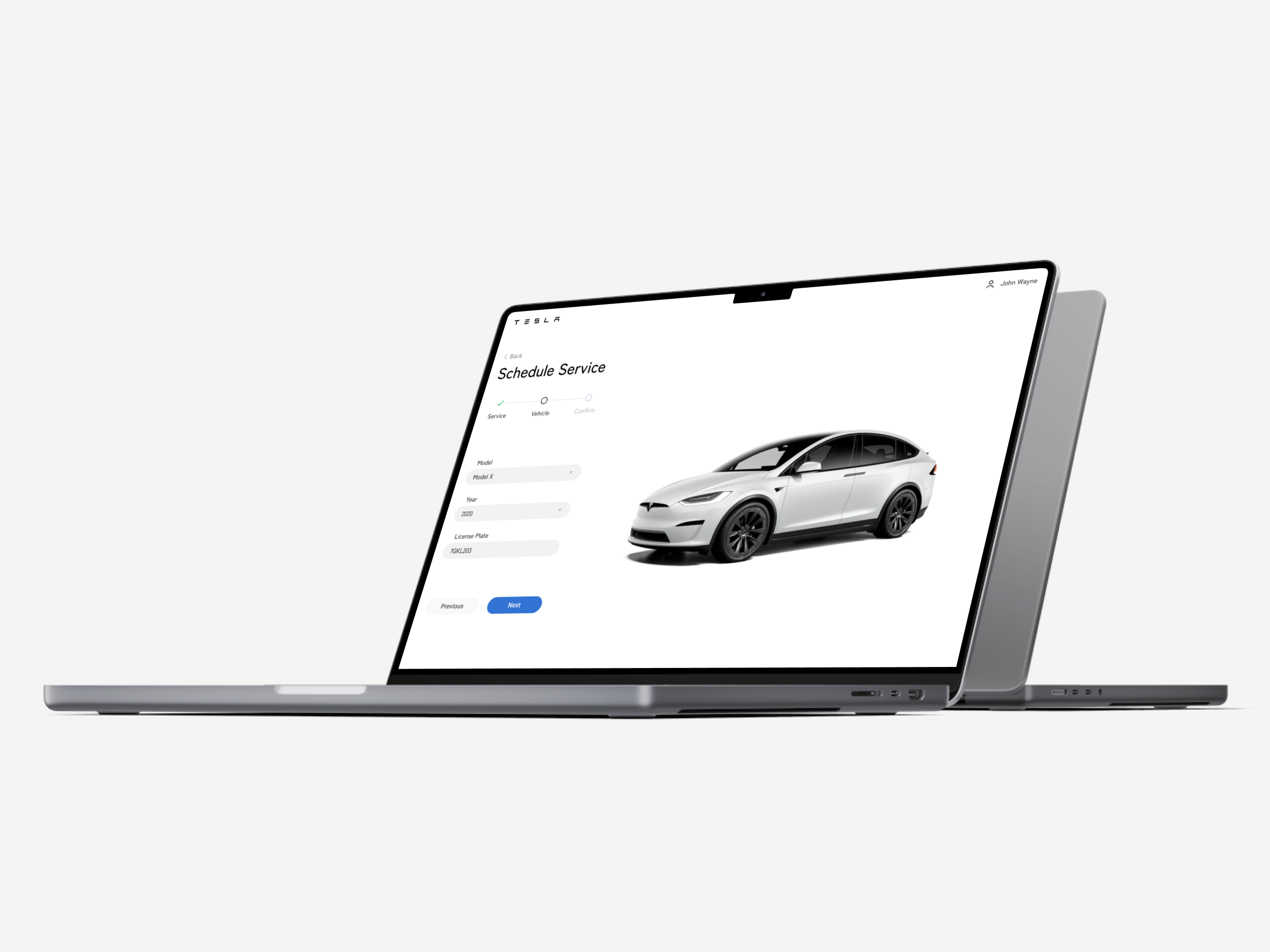

TeslaEnterprise, Design Systems

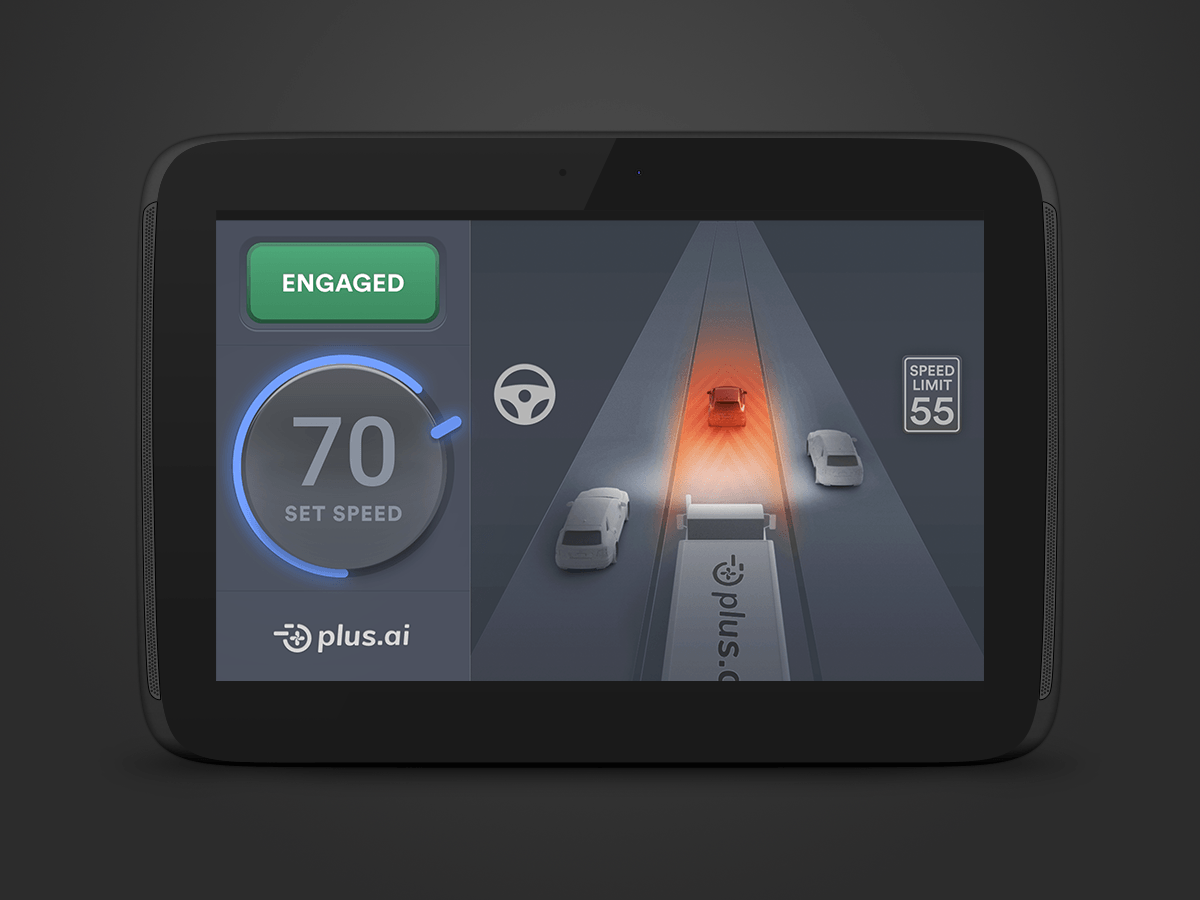

Plus.aiStartup

NxStopStartup

PhotographyPersonal